What If I don’t have a business bank/credit card account and I mix business and personal transactions? This way, you can stay organized and avoid any potential legal issues. It is crucial to be as accurate and honest as possible when tracking expenses. Īlways remember that personal and business expenses are not supposed to be mixed as it will create a false business bookkeeping system. You can download your free accountability plan here. Third, if you received a refund for the purchased item, you must return the money to the business as it’s no longer expenses paid. It is considered within the timeframe if you claim your reimbursement within 60 days. Second, you must substantiate the business transaction within a certain period. Anything that is being reimbursed to an employee or the business owner must be a legitimate business expense. You must meet certain requirements for an Accountability plan to satisfy IRS standards.įirst, each expense must be business related. You can create a reimbursement system through an accountable plan if you purchase a business item with your personal cash rather than the business’s cash.Īn accountable plan allows you to reimburse yourself or employees for business transactions that were paid using your own money.

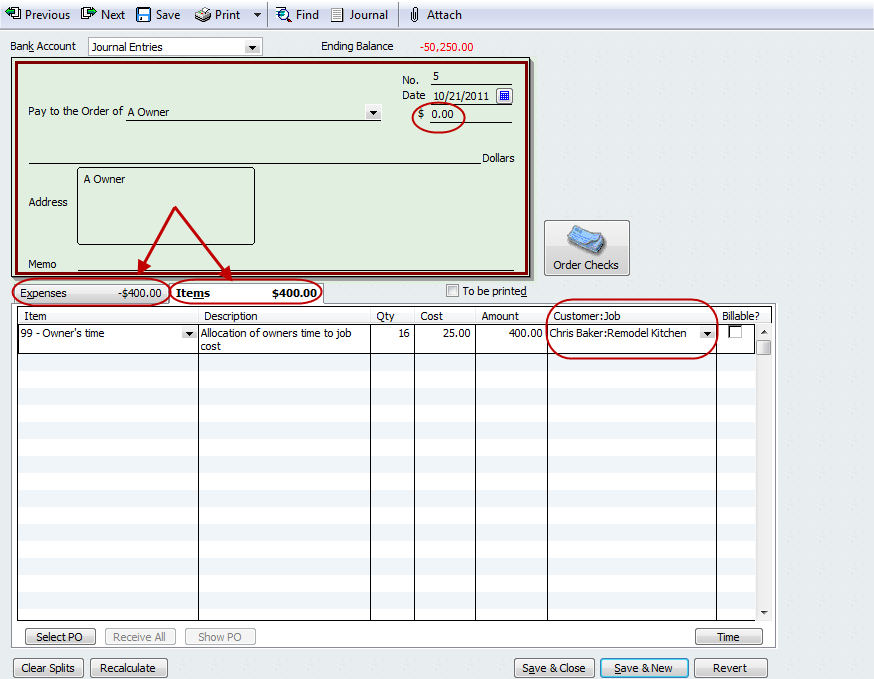

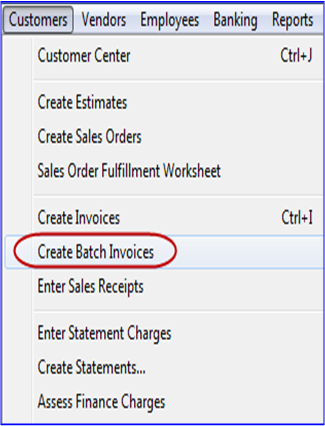

How to handle business transactions from my personal bank account? All you’ll want to do is review personal transactions coming from your bank feed in QuickBooks and categorize them as an owner’s draw. You can record personal transactions by creating an owner’s draw account. The Owner’s Equity is the owner’s portion of the business. Always remember, equity is represented as follows: Assets – Liabilities = Owners Equity. This could mean keeping track of what you purchased and recording them in an equity account. If this is you, you will need to create a system to ensure that the money is properly accounted for. Throughout my experience working on business bookkeeping, I found owners sometimes use their business bank accounts for personal expenses. It’s important to be as specific as possible when categorizing your expenses, so you can track your spending and identify any patterns. Mis-categorization can lead to inaccurate reports and an inability to reconcile accounts. The biggest mistake made with personal expenses in QuickBooks Online is not properly categorizing them.

What is the biggest mistake made with personal expenses in QuickBooks Online? In this article, you will learn how to separate business and personal transactions and record them in your company books the right way. However, tracking down all personal expenses you’ve paid with business funds can be challenging. When you run a business, your expenses are important. How to Record Personal Expenses Paid With Business Funds

0 kommentar(er)

0 kommentar(er)